Take Back Your Financial Power and Freedom After Bankruptcy

Rebuild Your Credit Score Fast with our Five Step Program

If you are worried about rebuilding your credit after bankruptcy, this message is for you.

You don’t have to wait years to regain the financial stability you once enjoyed. With Rebuild Your Credit, Rebuild Your Life, you can make a quick recovery after bankruptcy, taking back your financial confidence, security, freedom and pride.

Our five step credit rebuilding course will show you the fastest route to regain your financial prowess after bankruptcy.

Restore your Confidence to walk into any car lot and drive away with the car of your dreams.

Relish the Freedom to choose from credit card offers with low interest rates, exclusive rewards and no annual fees.

Rest Secure when you hold an approval letter from the bank when hunting for your dream home.

Revel in the Pride of knowing that your credit score can get you approved for almost any loan that you desire.

Allow Me to Introduce Myself and Tell You Why I Created this Course

Hello, my name is Don Golden, and I am the creator of Rebuild Your Credit, Rebuild Your Life.

As a board certified bankruptcy lawyer, I have watched too many people cower in fear of bankruptcy.

- Many are afraid to get back into the credit market because they don’t ever want to go bankrupt again.

- Others think they’ll never be able to re-establish credit, so they don’t even try.

Here’s the truth: in today’s world, you need to have good credit, Ill tell you why in a minute. But First I want you to know something that's equally true: I don’t ever want you to have to file for bankruptcy again.

I’ve seen people file for bankruptcy more than once. And it breaks my heart.

I started to wonder if there was a way that I could help fix their financial problems before they ended up in bankruptcy for the second or third time. Plus, I wanted to help them repair their credit after bankruptcy so that they could enjoy the benefits of good credit – without the fear of making the same mistakes again.

That’s why I started Fresh Start for Life and Rebuild Your Credit, Rebuild Your Life. I wanted you to be able to achieve the financial life of your dreams.

The first step to financial peace after bankruptcy is to understand the importance of your credit score.

5 Reasons You Need to Rebuild Your Credit Score

____

I promised I’d tell you why good credit is essential in today’s world — even if you’re afraid of getting into debt.

Judge Anthony J. Trenga sums it up here:

“Credit is the lifeblood of the modern American economy, and for the American consumer, access to credit has become inextricably tied to consumer credit scores as reported by credit reporting agencies.”

Our lives are tied to our credit score.

If you’re reading this page, I’m going to assume that you already understand the importance of rebuilding your credit score.

But just in case you’re not convinced, here are five reasons why you need to rebuild your credit score after bankruptcy:

➲ Our economy is built on credit.

If we want to participate in the marketplace, we’d better care about our credit score.

➲ Higher credit scores have real-life perks like:

- lower insurance rates

- easier approvals when seeking housing

- the ability to qualify for better cellphone plans

- the privilege of turning on utilities without a deposit

➲ Good scores are necessary for good car loans.

If you want to buy that dream car, you’ll need to have a good credit score — or your interest rates will eat into your recreation budget.

➲ Home ownership relies on a good credit score.

A good credit score could save you hundreds of thousands of dollars over the life of a mortgage.

➲ You can take pride in a good credit score.

The feeling that comes from recovering from the devastating effects of bankruptcy is priceless. There are additional benefits to regaining your credit score — and we’ll share those with you when you go through Rebuild Your Credit, Rebuild Your Life.

Don’t let fear keep you from entering into the credit arena. We’ll teach you how to stay safe with your credit so that you don’t fall into the pitfalls that got you in trouble in the first place.

How Fast Can You Rebuild Your Credit Score after Bankruptcy?

This part really excites me.

Everyone assumes bankruptcy impacts their credit score. And they’re right. But what many people don’t know is exactly HOW it impacts their score.

To the surprise of many, there’s a small group of people whose credit scores actually IMPROVE because of bankruptcy.

In the course, we’re going to help you discover if you’re in this elite group of people. At first, it may seem like a good group to be in. However, the reality might surprise you.

Regardless of how bankruptcy affects your credit score…you can almost be sure to start the process with a score in the 500 range.

When you follow the steps in our course (there will be action steps)

— you can expect to see your score rise to 720 in 12-24 months

— in many cases, within 12 months.

I’ll share the buying power you’ll have with a 720 credit score in the next section. But now, let me tell you how quickly you can begin to see changes in your credit score after beginning our program.

It is not just possible, but very likely, to see improvements in your credit score immediately after taking the steps in our course.

That’s exactly what happened to a recent student.

Tom Rombaugh, student of Rebuild Your Credit, Rebuild Your Life, wrote to tell us that he saw a significant improvement in his credit score within a few weeks of starting the course:

“I have already made some steps to rebuild and have gone from 540 to 600 in a few weeks.”

That amounts to a 60 point increase within a very short period of time — just by applying the steps we teach in this course.

In Rebuild Your Credit, Rebuild Your Life, we don’t teach theory: we show you how to get results — fast.

Next, we’ll discuss the significance of the number 720.

What Can You Do With A 720 Credit Score?

A 720 credit score provides you the buying power to do just about anything you desire.

Qualify for elite credit card offers with lower interest rates and no annual fees so you can feel more secure in emergency situations — and start earning rewards like frequent flyer miles or cash back

Get unsecured loans with low rates to save you money when you buy the things you need to maintain your quality of life.

Save money on insurance premiums and other consumer products that rely on higher credit scores.

Plus, you’ll be:

Seeing interest rates drop across the board

Qualifying for some of the best car loan rates at your favorite dealership

Getting close to that new home you’ve been dreaming about

A 720 credit score has many benefits. It’s like carrying credentials in your pocket that say, “I can handle those payments” — even though you’ve gone through bankruptcy.

What Do You Get When You Enroll in The Course?

Rebuild Your Credit, Rebuild Your Life will walk you through 5 life-changing steps to rebuild your credit score to 720 in as little as 12 months.

The 5 steps are broken down into modules packed with actionable items that will restore your confidence and renew your buying power.

➲ Module One: Bust the Myths Holding You Back from a Good Credit Score

- Bust the bankruptcy myths that can hold you back from getting your dream house, new car, and the credit score you deserve.

- Bolster your confidence in how our system works as you start your credit-building journey — and find out how you can qualify for a credit card fast.

- Discover if you are one of the select few whose credit score improved BECAUSE of bankruptcy.

- Learn why building your credit isn’t about luxury — but an absolute necessity in the world we live.

➲ Module Two: Take the First Step to Improve Your Credit Score

In this module, we’ll reveal essential information that you need to build your credit quickly.

You’ll learn:

- How to get your hands on three vital documents that are fundamental to rebuild your credit.

- The proper time to access your credit report after bankruptcy. Pull it too early or too late, and you’ll waste valuable time and money.

- The only reliable source for obtaining your FREE credit report — and which agencies you should avoid like the plague — if you don’t want to compromise your privacy.

➲ Module Three: Learn to Navigate your Credit Score with Ease

Here we’ll demystify your credit report so that you can easily understand its four main components and how each section impacts your ability to obtain credit.

- You’ll learn which elements of your credit report have zero impact on your credit score — and which you need to keep a close eye on if you want toqualify for a car loan.

- How to avoid liability for someone else’s credit card or loan payments.

- The way your Public Records impact your chances of qualifying for a loan, how laws have changed, and how long negative information stays on your report.

- You’ll discover who can legally pull your credit report, how often, and how to avoid getting negative marks on your account that will make your score drop fast.

- We’ll show you how many times you can pull your credit report — and what kind of impact it has on your credit score.

And a whole lot more.

After completing this module, you will feel like a credit wizard.

➲ Module Four: How to Make Your Credit Report Attractive to Creditors

In this module, we’ll take a magnifying glass to your credit report and walk you step-by-step through each section to help you

- Find and fix errors that can hold you back from rebuilding your credit score, obtaining credit cards, and getting loans

- Learn why credit card companies don’t report accurate information on your credit score and what to do about it

- Get the facts about how your home mortgage affects your credit rating based on some tricky bankruptcy laws

- Find out if you have a claim against your past creditors for breaking this simple law against the Fair Credit Reporting Act (they may owe you money)

When you’re done with this module, you’ll know exactly what you need to do to make your credit report shine like a new penny.

➲ Module Five: Escape Arbitration that Will Slow Down Your Fast Results

This could be the most important module of the entire course. Here we are going to show you how to

- Get those speedy credit building results

- Repair damage on your credit report so you can start getting the credit score you deserve

- Recover your power to qualify for good credit card offers

More importantly, we are going to show you how to hold credit bureaus accountable for keeping your report accurate with a little known law.

Credit bureaus must follow a prescribed protocol when fixing your credit report — but they have found a loophole to ignore the law and strip you of your rights.

- If you ignore the steps in this module, you are putting yourself at risk of getting stuck in arbitration with the credit reporting agencies. This one mistake could drastically slow down your efforts at rebuilding your credit.

- We will show you exactly how to protect your rights so that you can get the fastest results possible.

- Follow our proven plan, and you will hold “leverage” over credit reporting bureaus that most people don’t even know about — and you can be sure the credit bureaus aren’t going to report about that.

If the credit bureaus don’t follow the law, you have the right to hold them accountable with a lawsuit. We’ll show you exactly how to protect yourself — and when it pays to hire a lawyer.

➲ Module Six: Rebuilding Your Credit Score with Revolving Credit

Here’s where the magic starts to happen. In this module, you’ll start living as if you have good credit NOW — with many of the perks.

We are going to show you how to take positive actions toward building your credit by securing a prescribed number of revolving credit accounts.

Plus, we’ll show you

- How to get guaranteed approval for a credit card regardless of your current score —and how to use it to build your credit score fast

- Which credit accounts you should avoid even though they are easy to get — AND WHY

- How to use your credit card regularly without paying a penny of interest or fees

- How you might have access to a credit card right now — that you could’ve started using yesterday — if you’d known about it

- The max balance you’ll want to keep on your credit accounts to assure your score keeps going up month after month

The above is merely a sampling of what you will learn in this module.

➲ Module Seven: Rebuilding Your Credit Score with Installment Loans

The magic continues in this module.

We’re going to show you how to acquire a secured loan (like a car loan or home mortgage) to prove to your creditors that you can manage your monthly payments. As a result,

- Creditors will want to loan you more money

- Your credit score will keep going up

We’ll also give you valuable information like

- Which loans you don’t want to pay off during your credit rebuilding process. Sometimes paying off a loan can actually cause your credit score to go in the opposite direction. We’re going to show you how to avoid this credit bomb.

- The name of a reputable finance company that loves to loan money to people recovering from bankruptcy. They will literally accept the shirt off your back as collateral. [This one tip is worth the entire price of this course.]

- Which banks and lending intuitions offer the best terms, interest rates, and give you the highest chances of success for acceptance.

After you complete the steps in this module, you’ll feel like you have good credit already. And it will only go up from there.

➲ Module Eight: Maintaining Stellar Credit for Life

This final module wraps everything up and ties it together so you can see how the entire course coalesces into a simple five step plan for rebuilding your credit and your life. By this eighth module, you should be well on your way to

- Building a 720 score in as little as 12 months

- Enjoying the credit you deserve and need in today’s world

- Earning a credit score that you can feel proud of after bankruptcy

And as a bonus, this module lays out a plan to help you maintain your stellar credit for life so that you’ll never have to worry about bankruptcy or creditors again.

We will provide you with a roadmap to get the financial life of your dreams.

How Much Do You Have to Invest to Get the Course?

This is usually the first question people want to know.

And it’s an important question. But there’s a question that’s even more important.

What will it cost you if you don’t get this course?

Here is one scenario:

First, your credit score will either stay the same, or keep going down. This may be fine for a while — if you’re tired of the problems with debt and want to steer clear of all credit.

🌱But what happens when the transmission goes out on your truck? Or, you want to buy a car that gets better gas mileage? Or you need a larger one?

🌱What happens when the washing machine dies? The refrigerator breaks down. You need a rental car.

🌱You want to move into a new home. Invest in some rental property. Buy a small vacation home in Wisconsin.

Life will inevitably throw unexpected expenses at you. And if your credit score is not prepared to back up an emergency, you’re going to have to pay outrageous interest — if you’re able to borrow money at all.

Interest rates can make a big difference in your buying ability. Let’s look at some conservative numbers.

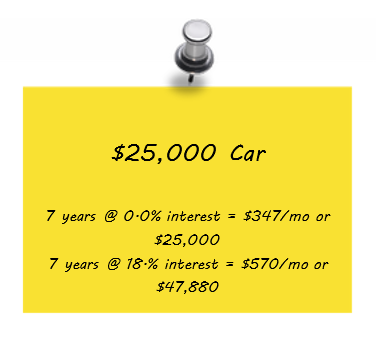

The Cost of A New Car

Say you’re looking for a new car and notice a 0% interest offer on a $25,000 car with no money down.

If you got approved for 7 years at that rate, your payment would be around $347 per month.

With a low credit score, your interest rate could be as high as 18% (or more), bringing your payments up to $570 a month.

That’s a potential savings over the life of the loan of $16,056 — no small figure — just for fixing your credit.

What about a house?

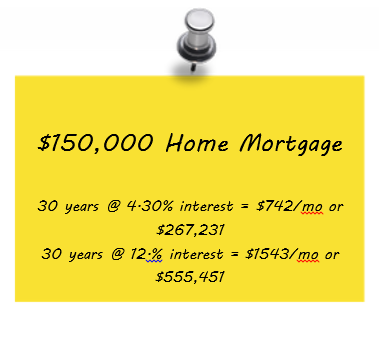

The Cost of A New House

You may be quite content with your home today. But what happens in three years when you are thinking about moving to a new house?

Taking this course could make the difference between being able to choose the house of your dreams or having to settle for something less desirable.

Even worse, it could end up costing you money that you could be investing in your retirement or spending on a vacation.

A $150,000 home mortgage at 4.3% interest for 30 years would cost you $267,231 over the life of the loan. At 12% interest, that same house would cost $555,451.

That’s a possible savings of $288,220 over the life of the loan — just for investing in Rebuild Your Credit, Rebuild Your Life.

That doesn’t include the savings on insurance, deposits for utilities, cellphone contracts, interest on credit cards, and the other savings you can expect from rebuilding your credit score.

The Cost of Not Getting This Course

Considering only the home and the car — by taking this course — you have a potential savings of $304,276 that you could spend on more important things, like:

Vacations

Family trips

Your retirement fund

You fill in the blank

What would you do with an extra $304,276?

With that kind of potential savings to our students, we knew we could easily charge $3997 for Rebuild Your Credit, Rebuild Your Life — and it would still be a fantastic value.

But we didn’t develop this program to get rich. We designed it to help you fix your credit score so that you can enjoy financial confidence.

So…after some deliberation, we concluded that $997 would be a fair price for the course — just a tiny fraction of the potential money you could save by reestablishing your credit score quickly. [I’ll show you how you can get the course for less in the next section.]

And $997 is the price that we’ve been offering Rebuild Your Credit, Rebuild Your Life to consumers for some time now. To date, we’ve had over 200 students enroll in our course.

But we wondered how we could help more people afford the course.

I Want to Rebuild My Credit and Rebuild My Life Now >>

Our Ironclad, 100% Money Back Guarantee

We don’t just want you to be comfortable with the price, we also want you to feel pleased with the results. That’s why we’ve come up with one of the most generous money back guarantees we can offer.

I’ve seen some excellent money back guarantees in the past: 30-days, 60-days, 90-days.

But today we are offering a 24-month money back guarantee — that’s two full years that you can test out the program.

If you go through our steps, follow the program, do the assignments, and stick to the plan — and your credit score does not get to 720 in two years or sooner — we will refund every penny: NO QUESTIONS ASKED.

Just show us how you followed the plan and provide us with a copy of your credit score and we’ll put the proverbial check in the mail, refund your card, or send you some bitcoin (if that’s how you paid).

We believe in our program so much, that we will stand by our promise for two full years.

What Will Your Credit Score Look Like in Two Years?

One thing is certain, you will have a credit score in two years.

Will it be 320? 460? 580?

With a score like that, you might be able to qualify for a “BuyHerePayHere” loan at 28% interest with a GPS under your hood so they can track you.

You might be able to find the perfect FSBO (for sale by owner) or Rent to Own home. Maybe they won’t check your credit. You’ll pay the high payments. Wish you could afford to update the flooring, fix the leaking roof, or have the yard landscaped.

Or…you could try something better:

…invest in your financial future

…improve your credit score to 720

…and buy the car or house you really want

— and have some money left over for vacations.

GET COURSE NOW >>

Improve Your Credit Score Now

It’s time to make a decision. Do you want to leave your financial future to chance?

- Never knowing if your score will improve

- Wondering if you’ll ever get to buy a new car

- Questioning if you can get your dream home someday

Or, do you want to rebuild your credit score quickly?

Here’s a quick recap of what you’ll get when you invest in Rebuild Your Credit, Rebuild Your Life:

A credit score of 720 in 12-24 months so that you can:

Qualify for great interest rates and save money across the board

Regain your pride and confidence to buy just about anything you want

Get the house or car you’ve been dreaming of faster than you thought possible

All in eight modules and five easy steps that will:

- Encourage you with the mindset to discover financial peace

- Educate you to regain your economic prowess and navigate the credit process with confidence and ease

- Eliminate and correct the things that limit your buying power

- Elevate your credit score quickly so you can start enjoying success fast

- Ensure that you qualify for credit cards and loans immediately — while your credit score continues to move upward

- Empower you to live the financial life of your dreams

And all that with a 2-year, no-risk, 100% money back guarantee.

Your future is in your hands. Are you ready to regain control of your credit score today?

Yes. I’m ready.